Explore the full potential of Flash Loans in DeFi with the Aave Clone Script, designed to replicate the success of the Aave platform. Effortlessly build your decentralized financial lending ecosystem with this innovative script.

Why Aave Flash Loans Popular?

Why Are Aave Flash Loans Popular?

Aave is a lending and borrowing platform that enables flash loans, quick-action loans that are quickly repaid without collateral. Flash Loans, an experimental technology, is made possible by the operation of the Ethereum network. If the principal and interest aren’t repaid within the specified time frame, the flash loan is automatically reversed.

Flash loans have many emerging use cases, making them one of the most unique technological implementations in decentralized finance (DeFi) today.

DeFi: Empowering Financial Independence and Exponential Growth

DeFi, or Decentralized Finance, aims to eliminate centralized control in financial transactions. It allows for the creation of decentralized ecosystems across various sectors, like banking, insurance, payments, and lending, based on robust business ideas.

Revenue in the DeFi market is projected to reach US$17,740.0m in 2023. Revenue is expected to show an annual growth rate (CAGR 2023-2028) of 15.86% resulting in a projected total amount of US$37,040.0m by 2028. The average revenue per user in the DeFi market amounts to US$1,064.0 in 2023. Experts predict continued exponential growth due to its versatility and numerous use cases, asserting the unstoppable rise of DeFi.

The advantages of DeFi development include heightened transparency and reduced risks of fraudulent activities due to the peer-to-peer nature of operations. Users have complete control over their funds, and decentralized applications can be synchronized securely.

However, developing a DeFi platform requires expertise in intricate backend concepts. Hence, relying on proficient blockchain developers or reputable DeFi development companies like KIRHYIP is vital.

Financial Ecosystems

How Do DeFi Projects Address Their Financial Ecosystems?

There are many hurdles to overcome in the coming years, from adoption to development, but open finance such as DeFi projects continues to focus on creating an integrated ecosystem where all components can communicate with each other. As a result, we can connect different applications and deploy customized solutions.

Decentralized finance finds application in token development, insurance platforms, and lending protocol development. AAVE protocol stands as the top DeFi-based platform for lending and borrowing.

What is Aave?

What is Aave?

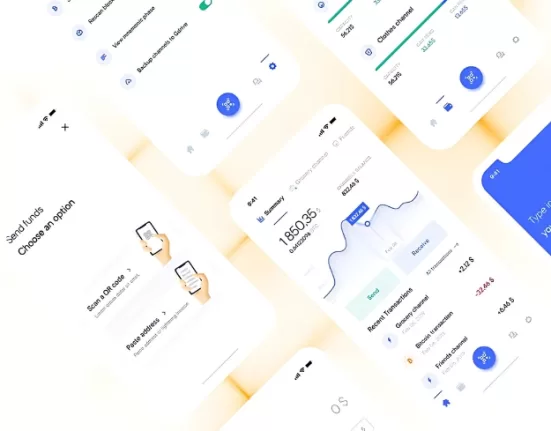

Aave is a decentralized money market protocol, widely recognized as a top lending and borrowing platform in the decentralized finance (DeFi) space. This open-source protocol allows users to both lend and borrow, offering fixed and variable interest rates. Users can earn interest on their deposits and borrow various assets.

Aave has gained substantial popularity, establishing itself as one of the leading DeFi platforms in terms of total value locked and user engagement. Entrepreneurs and business owners who want to quickly enter the cryptocurrency exchange platform would benefit from considering creating an Aave-like platform using the Aave clone script. This approach provides a simple and efficient way to leverage Aave’s successful features and functionality while customizing the platform to meet specific business needs.

Exploring the Features of Aave Clone Script

Support for Multiple Cryptocurrencies

Support for Multiple Cryptocurrencies

Offers Both Fixed and Variable Interest Rates

Offers Both Fixed and Variable Interest Rates

Facilitates Perpetual Loans

Facilitates Perpetual Loans

Compatible with Over 15 Ethereum-based Currencies

Compatible with Over 15 Ethereum-based Currencies

Certainly! Aave is a prominent participant in decentralized finance on the Ethereum Blockchain Network, distinguishing itself through innovative features that enhance user capabilities within the lending and borrowing space. In addition to collateralized borrowing and the creation of aTokens, AAVE provides a comprehensive array of functionalities:

1. Collateralized Borrowing

Users can borrow by depositing collateral equal to or exceeding the desired loan amount.

2. Lenders Receive aTokens

Aave lenders receive aTokens in return. These tokens in Aave represent the initial deposit and appreciation with additional earnings. They can be traded or redeemed for the initial deposit plus the accrued profits.

In simple terms, Aave’s platform lets people use their cryptocurrencies as collateral to get loans. Those who lend their money receive aTokens, like interest-earning tokens representing their part in the lending process. This setup makes DeFi accessible, allowing users to borrow money and earn passive income in the AAVE ecosystem.

What Sets Aave Apart?

What Sets Aave Apart?

The acceptance of liquidity from depositors and providing loans through different collateralization methods. Unlike other DeFi protocols, Aave grants users more freedom in their transactions as follows,

No lengthy registration process is required.

No lengthy registration process is required.

No mandatory submission of KYC (Know Your Customer) documentation.

No mandatory submission of KYC (Know Your Customer) documentation.

No need for AML (Anti-Money Laundering) documents.

No need for AML (Anti-Money Laundering) documents.

The platform provides business benefits such as flash loans, arbitrage trading, and flexible interest rates. Among all, Flash loans require no collateral and are monitored through specific apps like Collateral Swap and DeFi Saver.

Flash loan arbitrage bots automate the complex process of applying for flash loans, analyzing market data, and executing trades. This reduces traders’ manual workload and allows them to focus on strategy development and optimization.

Aave Flash Loans: Uncollateralized Lending in DeFi

Aave, a major player in DeFi, has revolutionized traditional lending models.

Flash loans changed the idea that loans must have collateral.

Flash loans changed the idea that loans must have collateral.

Unlike traditional loans, Aave Flash loans allow users to borrow without any collateral

Unlike traditional loans, Aave Flash loans allow users to borrow without any collateral

This collateral-free lending mechanism explores new possibilities in DeFi.

This collateral-free lending mechanism explores new possibilities in DeFi.

It promotes greater liquidity and efficiency within the ecosystem

It promotes greater liquidity and efficiency within the ecosystem

How Flash Loans Work in DeFi?

How Flash Loans Work in DeFi – A Quick Guide

To ask for a loan, a borrower sets up a smart contract with three main parts:

1. Loan Component

This part kicks off the flash loan and states how much to borrow from the loan protocol. A lending protocol is a decentralized platform on the blockchain that lets users lend and borrow digital assets without needing a bank’s approval.

2. Communication Component

This part of the smart contract handles communication with other smart contracts and DeFi platforms.

3. Refund Component

This part is responsible for giving back the borrowed funds, plus a small transaction fee, to the credit protocol in the same transaction. It must happen before the transaction completes, or everything gets reversed.

Quick and Easy Credit

Aave’s Flash Loans: Changing DeFi with Quick and Easy Credit

In a nutshell, Aave’s Flash Loans demonstrate how DeFi can be more adaptable and responsive, making it simpler for people to use financial services. They’ve found uses in various DeFi activities like trading and settlement processes. Traders use these loans to profit from price differences between different platforms, making the most of market inefficiencies without needing much upfront money.

As DeFi keeps growing, Aave’s role in unsecured lending sets a new standard for the industry’s ongoing quest for efficiency and progress. By removing the need for traditional networking, Aave has not only improved access to financial services but also paved the way for a more lively and responsive decentralized financial space.