The rapid pace of the cryptocurrency market has made automated solutions like crypto trading bots an essential tool for traders looking to maximize profits with speed and precision. Now, with the integration of artificial intelligence, these bots have become even more powerful, capable of analyzing vast datasets and making data-driven decisions faster than any human. This advancement has driven an enormous demand for AI-based bot solutions in the trading industry.

If you’re considering leveraging this opportunity, now is the ideal time to launch your own profitable bot. However, creating a high-performing solution requires an expert development partner.

KIRHYIP is the leading crypto arbitrage trading bot development company, now delivering sophisticated AI-powered bots that help traders succeed in the crypto market. If you’re ready to get started, our innovative solutions can make your vision a reality. Let’s start with a simple explanation.

What is an AI Crypto Trading Bot?

What is an AI Crypto Trading Bot?

An AI crypto trading bot is an automated software that utilizes artificial intelligence and machine learning algorithms to carry out trades on cryptocurrency exchanges. These bots analyze market data, predict price movements, and make real-time trading decisions based on predefined strategies.

These bots combine advanced analytics, predictive modeling, and fast execution to take advantage of market opportunities that would be impossible for manual traders to catch. They’re designed to help investors maximize profits, mitigate risks, and optimize trading strategies. With the basics covered, let’s explore some of the top AI-based trading bots available today.

Best AI Trading Bots in the Market

Best AI Trading Bots in the Market

-

3Commas

3Commas

-

Cryptohopper

Cryptohopper

-

Pionex

Pionex

-

Quadency

Quadency

-

TradeSanta

TradeSanta

-

WunderTrading

WunderTrading

-

Coinrule

Coinrule

-

Bitsgap

Bitsgap

How an AI Crypto Trading Bot Works

How an AI Crypto Trading Bot Works

Collecting Market Data

The bot first collects and analyzes vast amounts of data from the crypto market, including real-time price movements, historical trends, trading volumes, and even social media sentiment. This data enables the bot to understand and keepup with ongoing market trends.

Using AI and ML for Predictive Analysis

Utilizing machine learning algorithms, the bot identifies patterns that often precede profitable market movements. By training on historical data, the bot learns which market conditions might lead to gains, helping it make accurate predictions.

Executing Trades

Once the bot has analyzed the market and identified potential trading opportunities, it executes trades based on predefined rules and strategies. These strategies could be trend-following, mean reversion, or scalping, among others. The bot can place buy and sell orders automatically, without any human intervention.

Continuous Learning

Advanced bots use reinforcement learning to improve their trading decisions over time. When they make profitable trades, the AI updates its decision-making framework to seek similar opportunities. If a trade results in a loss, the bot adjusts to avoid repeating that action.

KIRHYIP Launches AI Crypto Trading Bots

How KIRHYIP Supports Entrepreneurs in Launching AI Crypto Trading Bots

At KIRHYIP, we offer end-to-end AI crypto trading bot development services to help entrepreneurs at every stage of their journey. Whether you need a simple bot for basic trading or a complex, multi-strategy bot for high-frequency trading, we’ve got you covered.

1. Initial Consultation and Market Research

We begin by understanding your business goals and market niche. Our team conducts thorough market research to ensure that the bot will meet the needs of your target audience. Whether your focus is retail traders, institutional investors, or crypto hedge funds, we tailor our solutions accordingly.

2. Development and Customization

Once we understand your needs, we start developing your custom AI crypto trading bot. This involves:

- Bot Architecture Design: Choosing the right algorithms, machine learning models, and data sources.

- Integration with Exchanges: Seamlessly connecting your bot to the top crypto exchanges using API integration.

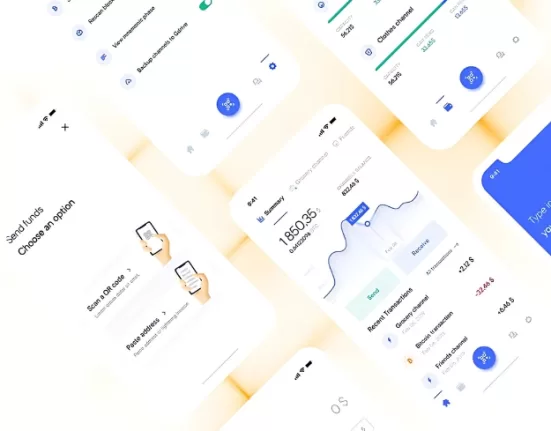

- UI/UX Design: Crafting an intuitive user interface that allows you to configure trading strategies, monitor performance, and manage risk.

3. Backtesting and Optimization

We rigorously backtest your bot on historical data to ensure it performs optimally. Our team fine-tunes the bot’s parameters and continuously improves its trading strategies.

4. Deployment and Ongoing Support

Once your bot is up and running, we offer ongoing monitoring, optimization, and support to guarantee its sustained success. We also offer updates as needed, so the bot can evolve with the market.

Read Along: Looking to supercharge your trades? Discover how KIRHYIP Solutions’ bots can help!

Key Features of our AI Crypto Trading Bots

Key Features of our AI Crypto Trading Bots

-

Market Data Collection & Analysis

Market Data Collection & Analysis

Our bots collect and analyze real-time market data, including price movements, trading volume, order book data, and historical trends. This data is essential for detecting trends, evaluating market strength, and backtesting strategies. We transform raw data into a usable format for machine learning models to process, helping predict future market behavior with greater accuracy.

-

Artificial Intelligence & Machine Learning Integration

Artificial Intelligence & Machine Learning Integration

Using models like supervised learning (training on past data) and reinforcement learning (improving strategies from real-world results), they recognize price breakouts, support/resistance levels, and chart patterns. This allows our bots to make smarter trading decisions and stay ahead of market changes.

-

Trading Algorithms & Strategies

Trading Algorithms & Strategies

Our AI bots utilize a variety of trading strategies, including technical analysis (e.g., RSI, MACD, Bollinger Bands) and sentiment analysis from news and social media. These strategies allow the bots to respond to real-time market conditions and adjust trades as needed. Additionally, the bots optimize portfolio management by rebalancing assets, diversifying risk, and adjusting allocations to maximize returns while aligning with the user’s risk tolerance.

-

Order Execution & Trade Management

Order Execution & Trade Management

Our bots autonomously execute buy and sell orders based on real-time analysis and pre-set strategies. By integrating with exchange APIs, they ensure seamless order execution. The bots also include risk management features such as stop-loss and take-profit, automatically closing positions at predefined levels to keep trades aligned with the user’s risk preferences.

-

Multi-Exchange Support

Multi-Exchange Support

Our bots are designed to connect with multiple exchanges like Binance, Kraken, and Coinbase Pro, ensuring better liquidity and enabling the bot to take advantage of arbitrage opportunities. This multi-exchange support allows users to diversify trading strategies across platforms, improving the bot’s adaptability and reach for optimal performance.

-

Cloud Deployment & Scalability

Cloud Deployment & Scalability

To ensure continuous operation, our AI trading bots are hosted on cloud platforms such as AWS, Google Cloud, or Azure. This provides 24/7 uptime, scalability, and flexibility, allowing the bots to handle increased traffic and complex trading strategies with ease, adapting as your needs grow.

-

Security Features

Security Features

Security is a top priority for us. Our bots come with secure API key management, two-factor authentication (2FA) for sensitive operations, and data encryption to protect all communication between the bot, crypto exchanges, and users. These measures help secure user data and ensure safe, reliable transactions at all times.

Our AI Crypto Bot’s Top Trading Strategies

Master the Market: Our AI Crypto Bot’s Top Trading Strategies

-

Trend Following Strategy

Trend Following Strategy

The bot identifies sustained market trends (upward or downward) and executes trades to profit from the momentum. If the trend reverses, it automatically adjusts to minimize losses.

-

Scalping

Scalping

The bot makes a high volume of small trades over short periods to profit from small price fluctuations. It executes quick trades based on minimal price movements, capturing frequent profits.

-

Mean Reversion Strategy

Mean Reversion Strategy

This strategy operates under the belief that prices will return to their historical average. The bot buys when prices dip below the average and sells when they rise above it, capitalizing on price corrections.

-

Portfolio Rebalancing

Portfolio Rebalancing

Our bot ensures that the asset allocation in your portfolio stays in line with your desired strategy. It automatically buys or sells assets to maintain the optimal balance based on market movements.

-

Risk Management – Stop-Loss and Take-Profit

Risk Management – Stop-Loss and Take-Profit

The bot uses stop-loss and take-profit levels to protect profits and minimize losses. It automatically exits trades when certain price thresholds are met, preventing emotional decision-making.

-

News Sentiment Analysis

News Sentiment Analysis

The bot evaluates news, social media, and market sentiment to make well-informed trading decisions. It reacts to major market events or trends by adjusting its trading strategy accordingly.

-

Trailing Stop Orders

Trailing Stop Orders

The bot adjusts the stop-loss dynamically as the market price changes. As the price increases, the trailing stop rises, locking in profits while allowing for further gains if the price continues to move in your favor.

-

Grid Trading

Grid Trading

This strategy sets buy and sell orders at specific intervals above and below the current price. The bot profits from price fluctuations within a set range, executing trades at different levels to capture price swings.

-

Copy Trading (Social Trading)

Copy Trading (Social Trading)

The bot replicates the trades of successful traders or top-performing bots. It automatically copies trades from experts, allowing you to leverage their strategies and benefit from their market insights.

Difference between Trading Bots and AI Trading Bots!

Difference between Crypto Trading Bots and AI Crypto Trading Bots!

Crypto trading bots and AI crypto trading bots both automate cryptocurrency trading, but they operate differently in terms of complexity, adaptability, and decision-making capabilities.

1. Decision-Making Process

- Crypto trading bots rely on pre-programmed rules based on technical indicators like moving averages or RSI to make decisions.

- AI-driven systems utilize machine learning algorithms that analyze vast amounts of data and adjust trading strategies based on changing market conditions.

2. Adaptability

- Traditional bots follow predefined strategies, such as triangular arbitrage, and cannot adapt to dynamic or volatile market conditions.

- AI crypto trading systems continuously learn from data, adjusting their approach in real-time to respond to new patterns and shifts in the market.

3. Data Analysis

- Crypto Trading bots focus on price movements and technical indicators to make trade decisions.

- AI crypto trading bots go beyond that, analyzing diverse data sources, including market sentiment, news, historical data, and even social media trends to inform trades.

4. Complexity

- Traditional bots use simple, fixed algorithms to execute trades.

- AI-powered systems are far more sophisticated, making complex predictions and adjusting strategies based on learned experiences from past trades.

5. Learning Capabilities

- Crypto trading bots don’t improve over time—they operate based on a static set of rules.

- AI-driven trading bots are capable of refining their strategies, using reinforcement learning to enhance their performance as they gather more experience.

6. Market Adaptation

- Regular crypto trading bots are limited by static market conditions, often struggling when market dynamics shift unexpectedly.

- Crypto AI trading bots are designed to quickly adapt to sudden changes, forecasting potential trends and executing trades to capitalize on those opportunities.

Why KIRHYIP Stands Out in AI Trading Bot Development

Why KIRHYIP Stands Out in AI Crypto Trading Bot Development

KIRHYIP Solutions is a leading crypto trading bot development company that combines years of expertise and a proven track record in cryptocurrency exchange script development. We specialize in designing AI-powered trading bots tailored to maximize trading efficiency and profitability. Our bots utilize advanced algorithms to analyze real-time market data, execute trades with accuracy, and help you capitalize on profitable opportunities in the fast-paced crypto market.

In addition to developing AI crypto trading bots, we offer a wide range of complementary services to ensure your success. We provide seamless integration, ongoing bot maintenance, strategy consulting, and market analysis to optimize your trading experience. Our dedicated support team is always available to assist you, ensuring that you get the most out of your investment. Ready to elevate your trading game? Partner with KIRHYIP today and let’s turn your crypto trading goals into reality!